Conversations with a Singaporean friend who recently emigrated have given me new perspectives about life in Singapore.

Me: Tell me why you migrate again…

Friend: Because my family and I can start appreciating life.

Me: Can’t you do that in Singapore?

Friend: Do you know anyone in Singapore who works because they want to and love to? For that matter, anyone who spends more time enjoying their kids then administering them? I don’t. I don’t want to miss out on living as life was meant to be lived. I am also obsessed with being debt-free.

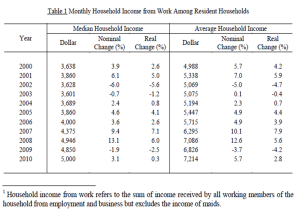

He shared with me how much his monthly household expenditure is. To get a sense of perspective I went to check the latest median and average household income in the Singapore 2010 population census report. (see table)

At the prevailing exchange rate, what my friend spends monthly is half of the median household income in 2010, and about one-third of the average household income. The monthly expenses cover his two sons’ education, insurance, medical expenses, food, petrol, utilities, phone, cable internet, mobiles and newspapers. Oh, did I mention his home – a freehold landed property with gardens and backyard – and a nice car (second hand) are fully paid for?

I felt giddy-headed upon seeing the numbers. The possibility of a debt-free life. WOW.

The concept of being debt-free is something I have entertained but consigned to the box called “wishful thinking”. Don’t get me wrong. My life in Singapore is pretty comfortable. My husband and I work hard. We have stable jobs and incomes. We managed to sell our first apartment at a good price and buy a replacement apartment that costs less than S$1 million. We invested the surplus before we squander the money away. We pay our mortgage on time. We drive an off-peak car. We take public transport. We are thankful we have the life we have in Singapore. Not a moment passes without us being grateful for what we have in our lives.

Yet, deep down I suspect that no matter how hard we work here, we will always be working to pay off this bill, that loan, mortgage, etc. Even when we pay off the 30-year loan in 29 years, we still do not own the property as it is a 99-year leasehold property. Technically, we are renting it from the government.

Sure, if we are lucky and the government continues to focus on “asset enhancement” and/or we catch the en bloc fever, we could one day find ourselves profiting from selling our property. Then we have to worry about buying the next home – can we afford that? Being debt-free just seems impossible in Singapore.

My friend shared an observation his Dutch friend once made of Singapore – Singaporeans only borrow land (99 years) and cars (10 years) from the government. Is it so obvious to outsiders? I didn’t see it until very recently.

Oh. Then there is the issue of kids. We are trying to start a family. My friend said to me, unless you are a millionaire in Singapore, parenthood is a pain.

For a while now, my Singaporean husband and I have been exploring the question: What is the future we live into in Singapore? What life can we look forward to in Singapore?

We have just started to look for clarity and answers. We know that our future is shaped by the choices we make now. We are also clear that the choices we make now are shaped by the future we see is possible.

My husband and I have had long talks about the life we want for our family and as individuals. We do not want to spend our entire lives in a rat race and being a slave to our home and material possessions.

No, we do not pretend to aspire to live like monks and nuns, devoid of material indulgence. The bottom line is this: we want a life that allows us to appreciate the materials things in life, rather than a life that is driven and defined by the acquisition of these.

The journey towards clarity continues.